24 March 2023

Transparency and Beneficial Ownership in the UK Property Market

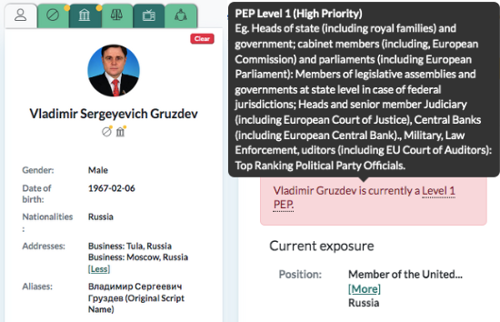

While it is nothing new to hear stories of corrupt elites owning UK property in rather dubious circumstances, The Times published a joint investigation with Transparency International earlier this month that showcases the truly brazen manner in which some individuals linked to illicit activities purchase and maintain property in the country. In one case, it was revealed that a multi-million pound flat in Kensington was registered to the eight-year-old daughter of Vladimir Gruzdev, a close associate of Putin’s. This begs the question – should eight year olds really be able to own property in the first place and how can the UK better monitor politically exposed persons using family as a screen to conduct business and personal dealings?

Gruzdev, who made his name in Russian politics and has an estimated net worth of $900 million, first purchased his Kensington property for £2.3 million in 2000 through a company based in the Cayman Islands. Records show that his eight-year old daughter was declared owner of the property in February of last year, 20 days before Russia launched its full-scale invasion of Ukraine. In the days immediately before and after the invasion began, individuals connected to Putin used various tactics to protect assets from potential sanctions, such as transferring company shares or property to family members and close associates. While Gruzdev is not sanctioned by the UK, he is a high priority PEP due to his positions within the Russian government.

Current state of UK property market transparency

Following the passing of the Economic Crime (Transparency and Enforcement) Act, the UK launched the long-awaited Register of Overseas Entities in August 2022, which requires overseas entities owning property in the UK to report who their beneficial owners are. While a January deadline was set for existing entities to register, over 18,000 offshore companies (accounting for 50,000 properties) either failed to register or did so in a way that obscured ultimate beneficial ownership.

Beyond failure to register, other gaps have been identified in the UK’s quest to effectively monitor foreign corruption across the property sector. For example, Transparency International uncovered 33 houses, flats and office blocks that were not marked as restricted on the UK property register but have been publicly linked to sanctioned individuals, raising the question of whether these properties should have been flagged by authorities. Transparency International also found more than £6.7 billion worth of UK property bought with suspect funds between 2016 and 2022, including £1.5 billion worth of assets bought with suspect funds by close allies to Putin and the Kremlin.

The misuse of relatives and close associates

Hiding behind relatives or close associates is a common tactic by corrupt and sanctioned individuals to attempt to skirt restrictions or hide assets in plain sight. These recent revelations reignite concerns over ineffective transparency across the UK property market, from abuse of opaque ownership structures to offshore front companies. The use of family members or close associates is often a key component of these structures, with individuals ensuring continued access and control over assets despite not owning them on paper.

In a Global Advisory published this month, the multinational REPO Task Force (of which the UK is a member) found that some sanctioned Russian elites and their financial networks have managed to evade sanctions and maintain access to funds or real estate through the use of family members. Under FATF definitions, Relative and Close Associates (RCAs) are individuals who share a family or friendship connection with a PEP whether through a direct family relation, a marriage, or a social or even professional association. RCAs may include parents, children, spouses, siblings, close friends, business associates, or legal advisors.

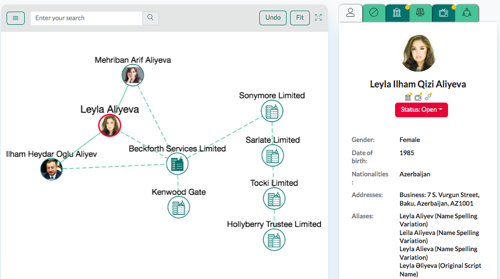

In one of the more infamous cases, it was revealed that Azerbaijan’s president Ilham Aliyev used an interconnected network of offshore companies and family members to acquire luxurious real estate in London, including a 19th century Bloomsbury Tavern. Aliyev’s son was just eleven years old when he became shareholder of a company owning $49 million in office spaces in Mayfair. In another case, Aliyev held the land title to a Hampstead property through an Isle of Man company Beckforth Services Limited, of which his eldest daughter Leyla was a shareholder. These shares have since been transferred to various other offshore companies.

Themis Search showcases the importance of checking connections when dealing with PEPs, especially those from high-risk countries due to corruption or sanctions. Our platform offers automated risk mapping capabilities so you can screen across as many degrees of separation as needed to get a full understanding of financial crime exposure. We provide extensive PEPs and RCAs coverage through access to over 215 million company records and 280 million individual directors in over 140 jurisdictions globally, as well as sanctions data from over 80 countries.

What's next for illicit finance and the UK property market?

Recent investigations based on data from the new UK Register of Overseas Entities have led to renewed calls by government and industry experts for strengthened regulations on transparency of property ownership, particularly around sanctioned individuals. In response, the UK Office of Financial Sanctions Implementation (OFSI) updated its guidance on breaches of financial sanctions earlier this month to outline expectations on ownership due diligence.

Also this month, FATF updated Recommendation 24 which provides guidance on transparency and beneficial ownership. Last year, the recommendation was revised to include tougher global beneficial ownership standards. The updated guidance is designed to help prevent corrupt individuals and sanctions evaders from using anonymous shell companies and other businesses to hide their dirty money and illicit activities.

The UK property market will be a crucial sector to keep an eye on over the next year as the country continues to grapple with how best to combat illicit activity and foreign corruption within its borders. Key questions remain to be answered around the effectiveness of the Register of Overseas Entities, as well as how the UK will look to enforce non-compliance with beneficial ownership requirements. We are certainly asking ourselves how many offshore networks and family-based opaque structures have we not yet discovered and what do these hidden connections mean for businesses and personal dealings?

Written by Eliza Thompson, Financial Crime Researcher, Themis