7 July 2023

Lebanon, a country once considered the “Switzerland of the Middle East,” is in the midst of a severe economic crisis that has shaken a nation already grappling with political instability and regional conflicts. An entrenched political elite has long run the economy for personal gains, undermining the credibility of the state. Inevitably, the economy has become hugely cash reliant given the severe drop in the value of the currency. In 2022, the World Bank estimated that the cash economy was worth close to $10 billion, or over 45% of Lebanon's GDP, a trend that is likely to persist, if not increase, as the population continues to distrust the banking system. Cash naturally lends itself to exploitation by criminals seeking to conceal illicit transactions and proceeds, exposing the country to greater opportunities for financial crime, a risk that must be recognised and addressed.

What caused it?

The economic crisis can largely be traced back to the post-civil war period that saw successive governments borrow huge sums of money, piling up debt beyond the nation’s means. As political instability in the Middle East surged following the Arab Spring of 2011, the budget deficit ballooned as support from regional allies began to decline and foreign currency inflows, including from tourism and remittances, slowed, resulting in the nation’s inability to repay its debts.

In an attempt to counter these slowing inflows of foreign currency, the Central Bank introduced a series of financial engineering reforms, which became known as ‘the swap’ to bolster its foreign exchange reserves. These reforms ultimately offered banks absurd returns for new dollars. Simultaneously, the governor of the Central Bank, Riad Salameh, increased borrowing of Eurobonds and lending to the state by buying government bonds.

By 2019, the economic instability created by the unrestrained borrowing of the sectarian elite had caused major tensions within the country. It came to a head in October 2019 when the government planned to tax WhatsApp calls, a proposed reform that further benefited the rich elite in Lebanon at the expense of the rest of the population. Mass protests erupted against the political establishment and foreign currency inflows and dollars dried up. In a report published by the World Bank in 2022, these financial reforms were likened to a ponzi scheme.

Government Mismanagement

Political instability, coupled with rampant corruption amongst swathes of the political and economic elite, has long rocked the country and further plunged it into chaos. There has been widespread mismanagement by the government and Central Bank to respond to and reign in the debt crisis which resulted in the currency being devalued by over 90% and inflation hitting triple digits. In August 2020, one of the largest non-nuclear explosions ever seen occurred at Beirut’s port, killing over 200 people and injuring thousands more; a disaster that reflected the state’s more general failures and continued entrenchment of elite graft. Though there were hopes that it would force a wider reckoning, that wish did not come to fruition given that all suspects were released in January 2023.

As the economic crisis has continued, a large proportion of the population have faced widespread poverty as their salaries are now no longer worth near their value prior to the crash. Given this hyperinflation, the prices of goods have skyrocketed and have meant many have been left unable to afford basic necessities, further exacerbated by the undermined quality of public services which has threatened the state’s social contract. The World Bank went so far as to downgrade Lebanon to a lower-middle income country given the near complete vanishment of the middle class, whereas Human Rights Watch fears food insecurity amongst the lowest-income bracket households.

Distrust of Banks

Public dissatisfaction has increasingly turned towards the banks as more and more of the population has struggled to withdraw savings following attempted capital controls imposed by the financial institutions. At the same time, the nation’s oligarchs and ruling families, many of whom own the banks, have continued to lend enormous sums of money to the government to fund payouts to Lebanon’s plutocrats. Transparency International scored Lebanon with 24 out of 100 (where 0 is the worst) in its most recent Corruption Perceptions Index (CPI) which measures the perceived corruption of a country’s public sector. Given the disillusionment felt amongst much of the public, it is unsurprising that Lebanon had such a CPI score.

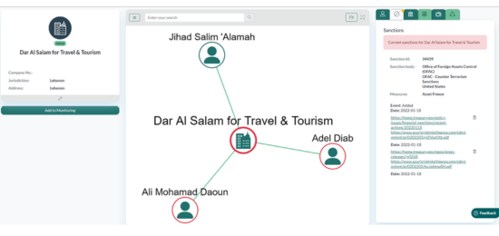

Riad Salameh has run Lebanon’s Central Bank, Banque du Liban, for nearly 30 years and has governed over what initially appeared to be great prosperity that transitioned the country from civil war into fancy boulevards packed with luxury restaurants. However, behind this was a precarious set of financial reforms that ultimately collapsed, leaving the populace short of cash. Salameh has himself been mired in controversy; currently under investigation in five European countries and Lebanon on suspicion of money laundering of public assets. Even more recently, Marianne Hoayek, a former assistant to Salameh and a senior adviser at the Central Bank has been indicted for suspected money laundering as part of an investigation into the supposed embezzlement of over $330 million. It is officials such as these that have further undermined the public’s confidence in the banking system. Our Themis Search risk map below charts the close relationship that Lebanon’s elite has had with the country’s economic centre.

Cash Economy

The loss of confidence in the banking sector has resulted in the Lebanese economy becoming heavily cash dependent. Given the economy’s instability, alternative financial institutions, such as money transfer companies have sought to fill the gaps left by the banks. However, many of these businesses are not regulated and Al Jazeera has reported that between 50 and 60% of Lebanon’s total GDP is within the shadow state. Part of this shadow economy includes illicit activities which are difficult to monitor and compromise the strength of fiscal and monetary policy.

As cash becomes further relied on, the economy will be increasingly exposed to financial crime vulnerabilities. The risk of money laundering has been heightened given the use of cash to obscure illicitly acquired assets and cash transactions threaten to reverse the progress made prior to the crisis to strengthen the financial integrity of Lebanon and implement broad anti-financial crime mechanisms.

Terrorist organisations, of the likes of Hezbollah, have also been able to flourish amid the growing cash dependent economy. As the foreign exchange companies began to fall short of the cash sought by Lebanon’s Central Bank, the former began to turn to the shadow network of foreign exchanges Hezbollah had established to acquire these dollars. The United States, for example, has sanctioned a number of Hezbollah-linked financial facilitators that have sought to exploit the financial crisis and fund their activities at the expense of the suffering Lebanese population. As seen in the risk map below, Lebanese nationals, Adel Diab, Ali Mohamad Daoun, Jihad Salem Alame were sanctioned by the US, alongside their Lebanon-based company Dar Al Salam for Travel & Tourism, for their role in facilitating the financing of Hezbollah.

FATF’s Response

Contrary to expectations, the Financial Action Task Force (FATF), the global watchdog on money laundering and terrorist financing, did not grey list Lebanon at the most recent plenary session in June 2023. The country narrowly avoided this however, scoring just one point above the threshold. FATF’s grey list identifies countries that are under particular scrutiny due to unsatisfactory practices to prevent money laundering and terrorism financing.

Regardless, Lebanon has not avoided increased international attention from a financial crime perspective. FATF has granted the country a one year period to introduce the necessary reforms related to financial, monetary, and banking reforms prior to revisiting a potential greylisting decision. In its assessment, FATF noted that Lebanon’s anti-money laundering measures, beneficial ownership transparency, and mutual legal assistance in asset freezing and confiscation, are specific areas of concern, scoring the country as ‘partially compliant’ against these metrics.

Lebanon will have to submit a progress report to MENAFATF during 2024 addressing the identified deficiencies and highlighting the corrective measures taken. Given the economic crisis, and in particular the move towards a cash-based economy, Lebanon must make a concerted effort to reform the country’s anti-financial crime legislative and regulatory regime so as to avoid greylisting at FATF’s next meeting.

Conclusion

Lebanon has a long road ahead to implement reforms that address the economic chaos that has dogged the country recently. Together with public disenchantment towards the banking sector and illiquidity of the economy, cash has become progressively depended on, resulting in the country becoming more exposed to financial crime by illicit actors vying to cash in on the instability. For the foreseeable future it appears that this situation will persist and as it does, it is important to stay wary of the risk exposure a cash based economy presents to individuals and businesses alike.

At Themis, we write in-depth country risk reports analysing the financial crime risks in specific jurisdictions and outlining those countries’ legal, regulatory, and institutional frameworks governing financial crime. Our reports are written in accordance with the Wolfsberg Group’s guidance on assessing jurisdictional risk and, therefore, reflect international best practice on conducting financial crime country risk assessments.

We have an extensive collection of jurisdictional reports available on our website, but also produce bespoke reports tailored to clients’ specific needs.