26 February 2024

Introduction

2024 is a year poised to mark a significant leap forward for the integration of Artificial Intelligence (AI) into financial risk mitigation. New generative AI (Gen AI) technologies, most famously ChatGPT, have recently exploded into prominence; for some, they offer utopian solutions to the world’s problems, for others, they augur an inevitable decline into a dystopian future.

The reality, however, is that AI-powered solutions have already been introduced in all sorts of sectors, from energy to entertainment, and finance is no exception. An executive briefing from Global Data indicates that the financial sector ranks third in the world for exposure to Gen AI, while one recent survey stated that AI is already being used, or evaluated for use, by a wide spread of financial institutions (91% of respondents).

Businesses are investing heavily in AI because they believe in its promise to promote innovation, improve operational efficiency, and optimise customer experience. In the ever-evolving landscape of financial crime, AI has emerged as a formidable ally, offering new solutions for risk detection, fraud prevention, and regulatory compliance for the public and private sectors alike.

Regulators are excited about the new possibilities: both FinCEN and the Office for Foreign Assets Control (OFAC) have signalled their openness to the private sector’s use of AI in financial crime prevention, sanctions management, and instant payment systems. Earlier this year, Nikhil Rathi, the Chief Executive of the Financial Conduct Authority, emphasised the promise of AI-driven compliance founded on high-quality data: “AI - when fuelled by rich data - has the power to tackle inefficiencies and therefore accelerate productivity, growth and inclusion”.

Although new national and regional regulation governing AI has already appeared (for example, in the introduction of the EU AI Act) and the regulatory landscape is likely to rapidly change further, authorities have made it clear that independent innovation in the private sector is to be welcomed.

The Dual Nature of AI in Financial Crime

Of course, there are reasons to be cautious about AI. As criminals adapt to AI technology to stay one step ahead of financial institutions (some are already using AI techniques, such as deepfakes and synthetic identities, to commit fraud), the need for advanced fraud prevention methods becomes increasingly urgent. There are many potential threats; for a comprehensive exploration of the risks associated with new AI developments in the financial crime landscape, see Themis’ white paper on the subject.

Yet the fight against financial crime has always been a game of cat and mouse, in which the tools employed by law enforcement and the private sector are inherently reactive to the evolving tactics of bad actors. This means that the shift toward AI-driven solutions is not optional, but rather an inevitable strategic move needed to combat the rise of AI-driven fraud.

Businesses should not greet this need to innovate with trepidation – they should welcome it. For institutions and individuals involved in the fight against financial crime, the development of new AI tools offers a great deal of promise.

The Rising Costs of Non-Compliance

This is especially true when one considers the soaring costs of the global financial security system. Increasing numbers of transactions, high-risk geopolitical volatility, and evolving sanctions regimes have meant that compliance with anti-financial crime legislation has never been so expensive: in 2022, global costs of compliance reached $206 billion.

These costs seem likely to only increase, with the entrenchment of sanctions as a foreign policy tool and new regulatory focus on formerly overlooked areas of criminal activity, such as environmental crime. Fortunately, it is precisely this challenge that many AI technologies aim to meet.

A Compliance Officer’s Best Friend

AI can decrease complexity for financial institutions, ensuring compliance with existing regulatory obligations by efficiently comparing and tracking changes. The integration of AI in risk mitigation has resulted in a surge of Regulatory Technology (RegTech) investment by financial institutions; projections forecast that spending on AI in this domain will double by 2027.

An example of AI automation already at work can be seen in software that takes the time-consuming process work of regulatory horizon scanning out of human hands, allowing firms to remain on top of their rapidly evolving legal obligations. The eruption of sanctions packages following Russia’s invasion of Ukraine has meant that compliance departments have had to screen against sanctions lists on a daily, if not hourly, basis.

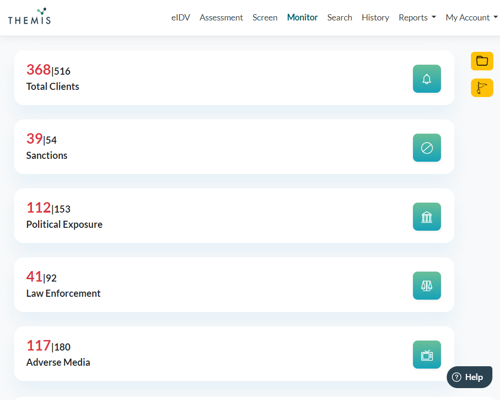

Fortunately, AI-powered technology has made the process of responding to new regulation much easier. For example, AI software underpins the Monitoring function of the Themis anti-financial crime platform; this allows businesses to place clients under ongoing review, not only for sanctions, but also for adverse media, new litigation and political exposure. Once in the system, clients are screened against a database which renews itself four times a day, with new alerts sent directly to the compliance department’s inbox.

These kinds of technological solutions are particularly promising for smaller businesses, both financial and non-financial, that must nevertheless comply with vast amounts of regulation. AI automation, in combination with the growing use of outsourced financial crime expertise, offers great cost-saving potential when compared to more traditional models of compliance departments.

AI Assistance in Democratising Due Diligence

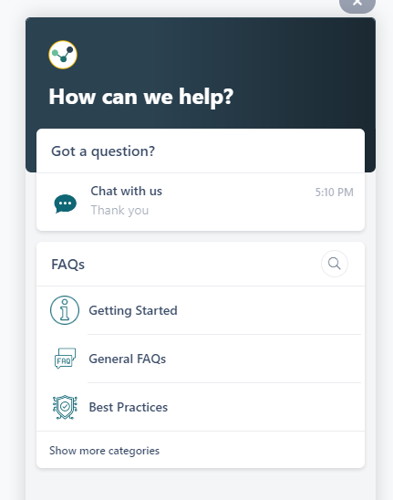

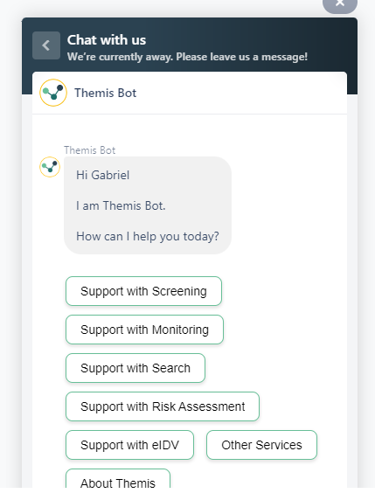

Although talk of technological innovation suggests an ominous increase in the complexity of anti-money laundering (AML) systems, AI actually offers great opportunities for simplifying financial crime technology platforms. A case in point is the use of AI to improve customer experience, through the development of advanced chatbots and voice assistants. These software applications, which rely on natural language processing (NLP) and machine learning (ML) techniques, engage with customers through text or speech, handling requests for guidance and answering FAQs without human intervention. Customer convenience and satisfaction are enhanced as waiting times and user errors are reduced, while the price of the service is not significantly affected.

This is the rationale behind the implementation of a new AI chatbot on the Themis Search platform. This tool, which provides users with comprehensive support at all times of day (or night), is specifically designed to meet clients' needs. It has been trained to answer a wide range of commonly asked questions, and to offer users additional support based on their requests. As a result, Themis has been able to greatly increase the user ease and enjoyment of its software, without drastically hiking up its price.

The incorporation of Gen AI tools into the platform will allow us to continue delivering these improvements. Developments in Gen AI promise transformative gains in the efficiency and quality with which businesses perform due diligence. Large language models (e.g. OpenAI’s GPT models) have the potential to greatly improve the speed and quality of AML processes; their ability to rapidly process vast amounts of data, and produce original content, allow them to help compliance officers streamline data collection, facilitate case record summaries, and assist in writing Suspicious Activity Reports (SARs).

The most positive consequence of these improvements in efficiency may be that effective anti-financial crime processes will become attainable for many more businesses, especially smaller enterprises. This is, at least, the goal of Themis. Our existing AI-driven innovations have already made our technology much easier to use than other databases, and they have allowed Themis to offer customers a full package of services and support at a lower price.

The opening of new horizons in AI development will only enhance this. For us, AI is an important ally in achieving our long-term aim of democratising due diligence, as it helps us to create a compliance solution that is not only effective, but also affordable and accessible.

Changing the Game

This should not give the impression, however, that AI technology will merely allow anti-financial crime practitioners to do what they are doing now, but in a somewhat faster and cheaper way. AI technology, in particular through new applications of Gen AI, promises to revolutionise how businesses deal with financial crime.

Gen AI excels at analysing vast amounts of data and identifying patterns quickly, two skills which lend themselves perfectly to the tasks of suspicion transaction monitoring and risk profiling. Gen AI models could enable financial institutions to not only fully automate fraud detection and prevention, but greatly improve it. Through its ability to assimilate complex data, and perform deeper analysis of behavioural anomalies, Gen AI might uncover frauds and fraudsters that are currently missed. It also promises to help reduce the number of ‘false positive’ transaction alerts, which are a significant problem for businesses today, and an ever-increasing risk for a future in which transaction numbers are likely to only continue going up.

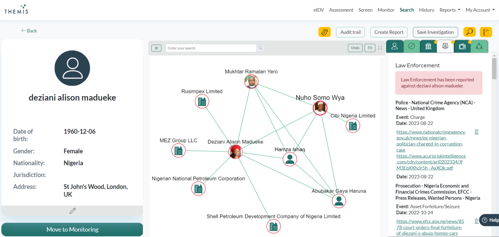

A concrete example of how novel methods of AI analysis offer a game-changing edge in tackling financial crime can be seen in the application of graph neural network (GNN) deep learning techniques to financial crime datasets. The expression of data in graph form, by displaying relationships between entities in a network of edges and nodes, allows financial crime investigators to uncover hidden connections in the information they possess. This is the key advantage, for instance, of Themis’s risk mapping function:

Yet beyond the link analysis of a single network that a human expert can perform, GNN models have the potential to identify patterns across an entire dataset of networks. In a financial crime context, this could mean that a platform like Themis’s will be able to alert a user to red flags around an entity, simply due to the similarity of its network structure to those known to be fraudulent or criminal. These sorts of insights have never existed before; if new AI solutions can unlock them, it would mark a genuine change in the financial crime landscape.

The Best of Both Worlds – Combining Human Intelligence and AI

But such optimism should not disguise the fact that AI solutions do not by themselves offer a magic cure for the various diseases of financial crime. AI-based processes offer a powerful tool in the fight against financial crime, but their effectiveness ultimately depends on who uses them, and how. Collaboration between human intelligence and AI, especially in generative AI, is a significant opportunity. Human experts are essential not only in training and improving AI compliance systems, but also in verifying and interpreting the results produced by complex models.

It is, however, sometimes extremely difficult, if not impossible, to fully understand how some AI models work, and why they produce the results they do. This issue, often termed the explainability problem of black box AI models, is a major obstacle to AI’s full implementation in compliance systems. Money laundering reporting officers (MLROs) and senior executives have to make decisions about potentially denying services to suspicious clients, and reporting them to legal authorities; clearly, they need to be able to justify, and explain, their actions. The growing use of advanced AI models in the anti-financial crime sphere brings with it a growing need for experts who can bridge the gap between man and machine.

Themis is an example of how artificial and human intelligence can successfully be combined to fight financial crime. Although it is on the frontline of AML technology innovation, Themis focuses as intensively on developing its human intelligence resources, and each aspect of its financial crime solution improves the other.

For example, while gaps and flaws in existing data sets are a long-standing problem for anti-money laundering systems and a fundamental challenge for the development of new AI models, Themis improves and expands its database with human intelligence. This is gathered through both granular financial investigations and system-level research on crime trends and typologies; human-generated knowledge is either incorporated into the platform or used in concert with it to produce threat-based advice and strategic recommendations for the public and private sectors.

This not only increases the usefulness of AI-driven financial crime technology, but also ensures its reliability and trustworthiness. The oversight and involvement of financial crime experts in the development of AI software makes it better, but it also makes it safer for and more palatable to the human users who will ultimately have to depend on it.

Themis aims to be a leader in applying AI-led solutions to the problems of financial crime, and we are uniquely placed to do so. With strong working relationships with governments and businesses of many shapes and sizes, our software is developed with the needs of the whole financial crime compliance ecosystem in mind. By combining a focus on innovative technology with leading human intelligence and insight, Themis is capable of not only meeting those needs as they currently are, but also anticipating them as they evolve in an uncertain future.

Written by Aine McParland and Henry Wyard,

Financial Crime Researchers in the Themis Insight Team